The key to starting a successful Airbnb is to accurately run the numbers on your chosen property to ensure you’re setting yourself up for success. There are many key factors & costs to include, over and above a standard property investment.

In this post I’m going to break down the main components to consider in the US market for your Airbnb. I’ll also take you through a live example of how to apply the analysis and provide you with a free template at the end so you can analyze your own Airbnb listing.

The key ingredients to determine the profitability of your Airbnb property

| 1. Determine the average cost of the property | Best to use Zillow or a similar tool. Don’t forget to add PMI if your downpayment is 20% or less |

| 2. Get on top of Local and State Rules on Short term rentals and taxes | Every state has its own set of regulations. Taxation can come from the state, as well as from the county and city levels. It’s important to keep in mind that property tax is also a factor. |

| 3. Lock down on your estimated utility costs | Gas, electric and other costs |

| 4. Get comparables for Airbnb income | Use a combination of Airbnb and AirDNA |

| 5. Calculate your mortgage / rent | Best to use use any mortgage calculator. Don’t forget PMI and insurance |

| 6. Deduct Airbnb fees | |

| 7. Include a management fee | Whether you self manage or not, this is always a good idea to calculate to make sure you pay yourself a fare wage |

| 8. Maintenance costs | Routine repair costs |

| 9. Cleaning, supplies & consumables | Estimates for cleaning costs and everything you use to clean and supply to guests |

| 10. Capital expenses | Big ticket expenses, like HVAC replacements, furniture, etc |

| 11. Subscription services | Wifi, Netflix and others |

How to Calculate the Average Cost of a property for Airbnb

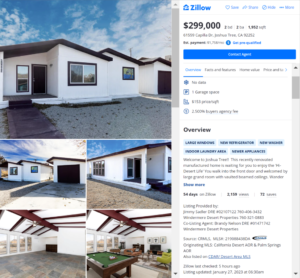

Determining the cost of a property can vary greatly depending on the location, making it challenging to find an accurate method of calculation. However, a good starting point is to consult resources such as Zillow and other real estate listing sites, but keep in mind that these sources only provide rough estimates.

For instance, Zillow is just a rough estimate and a real estate listing only reflects the seller’s asking price, which may not necessarily be what they end up selling for or what was paid for the property. Additionally, public records from the courthouse may not account for any additional concessions made.

When conducting research, it is important to keep in mind that the purpose is to only get a rough estimate and to make an informed decision. It is never advisable to make a real estate purchase based solely on a Zillow estimate. It is recommended to get a real estate comparison and conduct your own research to have a deeper understanding of the value of houses in your target area.

For this illustration, let’s consider a 2-bedroom, 2-bathroom house with a square footage of 1952, located in Joshua Tree, California. This particular property sells for approximately $299,000.

You can do this same exercise with rentals. Identify the property and get the monthly rental amount.

Now that we’ve identified the property and the base cost, let’s move on to the next step.

Calculating Taxes for Your Proposed Airbnb

When it comes to estimating taxes for your Airbnb property, it is important to take into consideration three key areas: state sales tax for short-term rentals, local taxes for short-term rentals and property tax. Additionally, some areas have special taxes designated for hotels, which may also apply to Airbnb rentals. It is also important to note that the tax responsibility may differ between states, with some requiring Airbnb to submit the taxes, while others require the host to account for it.

To determine the taxes for your Airbnb, start by researching the laws in your state. You can do this by using a search engine, or by calling the state’s main switchboard and asking to be directed to the appropriate office, such as the Accessors Office or the Revenue division. Similarly, check with your city to determine the city tax rate. The regulations and taxes for short-term rentals can vary greatly between cities, so it is important to familiarize yourself with the specific laws and codes in your target city.

To further understand the regulations and laws surrounding short-term rentals and landlord-tenant laws, you can visit the websites of the state and city directly. Another great resource is AllTheRooms.

Determining the Cost of Utilities for Your Airbnb

When it comes to calculating the cost of utilities for your Airbnb property, one option is to look for a list of included utilities provided by the listing agent for the house you are considering purchasing. Another option is to directly contact the relevant utility companies and obtain an estimate for the size of the house.

As a landlord, it is important to consider the cost of garbage disposal as well. You can either include this as part of your agreement with the cleaning crew, or expect to pay an estimated cost of around $30 per month, which may vary depending on your location.

How to Evaluate your Airbnb in terms of Income Projections

When it comes to estimating the income potential of your Airbnb, it’s important to keep in mind that not all information may be accurate. To get a better idea of what to expect, start by looking at similar properties on the Airbnb platform. Consider the rates they are charging, as well as the fee they charge for cleaning.

Examine the calendar of your competitors to gauge their occupancy and availability. Ask yourself questions such as, is their calendar mostly full? If not, is there a lot of competition or are their rates too high? Consider the attractions in the area and how that may affect the demand for your property.

Take into account the cost of utilities and the cleaning fee that your competitors are charging. Make sure your plans align with what the market is indicating. Check out multiple properties in your desired area and filter out the ones that are not similar to yours.

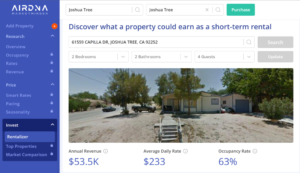

Another great resource is AirDNA. You can use their Rentalizer option to check your property’s expected earnings. I’ve done this for some of my existing properties and the results are scarily accurate, so it’s a good check.

In my research the Joshua Tree property I found that my subject property had the potential to earn approximately $235 per night (I rounded up), plus $110 for cleaning, with a turnover of 5 times. I estimated an average of 20 rental days per month (a 66% occupancy rate – slightly up from their 63%, since I’ve always done better than AirDNA’s estimates as a Superhost) , with cleaning fees of $110 x 5 times, assuming that a cleaning crew only comes in after a guest’s stay and not every day. My total estimated income would be calculated based on these assumptions.

How to Determine Mortgage or rental Payments for your new Airbnb

There are numerous mortgage calculators available online that can help you estimate your monthly mortgage payments. Like this one and this one. To use these calculators, simply enter the price of the property you’re interested in, the current interest rate, and the amount of your down payment. The current interest rate can be obtained from a loan officer.

As an example, let’s consider using a real estate app like Bankrate (also linked above). Based on the app, the current interest rate is 5% (which may differ depending on your specific circumstances and the time of writing vs when you’re buying). For a property with a $299,000 price tag and a 20% down payment, the monthly mortgage payments would be approximately $1,547. This amount takes into account $1,284 for principal and interest, $66 for insurance and a monthly property tax estimate of $197 (which is usually part of the mortgage escrow payments made on a quarterly, semi-annual or annual basis).

What Are the Airbnb Host Fees I Need to Pay?

As an online reservation platform, Airbnb charges fees based on the revenue generated by its hosts. The fee for hosts is a flat rate of 3% of the booking subtotal, which is comprised of the nightly rate and cleaning fee. This fee does not cover the 3% tax or the Airbnb Service Fee.

Airbnb earns revenue from two sources: the 3% fee paid by the host and the approximately 14% fee charged to the guest. The guest fee, referred to as the “service fee,” is a percentage of the booking subtotal and is separate from the host fee. When viewing an Airbnb listing, you will see the listed room or house rate, cleaning fee, and service fee, which is money earned by Airbnb and not paid to the host. More recently in Airbnb’s latest update, the guest can opt to see a final total amount, which will combine (and not split these) upfront.

You should however note that Airbnb has made changes to the service fee structure. In some areas, the entire fee is passed onto the host as 15% (excluding VAT, where applicable per country) and in some areas the host still has the option to pass on the largest portion to the guest.

The best resource for up to date fees, would be the Airbnb website.

How Much Does it Cost to Hire an Airbnb Property Manager?

When it comes to managing an Airbnb property from a distance, many homeowners opt for the services of a property manager. The cost of hiring such a professional is typically around 20-30% of the rental income generated from the property. This fee is on the higher side due to the hands-on nature of the day-to-day operations involved in managing an Airbnb property.

In the example cited, a property manager would earn an estimated $1050 to $1575 per month, which is a substantial amount of money to be deducted from your potential earnings. I settled on 25% in my calculations, which totaled $1312.50 per month.

For those who want to save on costs, you are able to manage it yourself, potentially with the help of a trusted relative, friend or even a virtual assistant. However, keep in mind that doing so can still come at a cost, especially when using an assistant. You can however make this much easier by using software, such as a channel manager, to automate a lot of your workflow.

Estimating maintenance Costs for Your Airbnb Property

When it comes to maintaining an average-sized home in good condition, you should anticipate spending approximately 1-3% of your monthly rental income on routine repairs. These could include tasks such as cleaning the furnace, unclogging drains, and other ongoing maintenance.

Keep in mind that this is simply an estimate, and older properties may require additional repairs and higher costs. Additionally, repair expenses can be unpredictable. Some months may require no repairs and others potentially double your estimated reserve, so plan accordingly and set some money aside each month using this percentage of income as your estimate.

What are the Costs of Cleaning and Supplies for an Airbnb Host?

The cost of cleaning an Airbnb property varies depending on the location, size of the property, and extent of cleaning required. On average, it ranges from $120 to $200 for a three-bedroom house, per cleaning visit. This cost is incurred based on the number of guest reservations, so if you had five guest reservations in a typical month, then you would need to pay for five cleaning visits. (One after each stay, before the next guests arrive).

If you use a professional cleaning service, they will typically provide their own supplies, so your out-of-pocket costs will be minimal. Keep in mind that regular supplies like soap, kitchen detergent, and toilet paper will not be covered by the cleaning service and would need to be provided by the host. Things that your guests use are referred to as guest consumables. However, some cleaning services may offer to restock these items for an additional fee, so factor that in if you use their services.

It’s important to note that the cleaning fee is charged to the guest, so it’s included in the overall income of the Airbnb rental and then deducted again as a cost. Sometimes the amount you charge your guest and what you pay your cleaners will differ.

Understanding Capital Expenses for your Airbnb & Budgeting for Them

As a smart Airbnb host, it is advisable to allocate approximately 1-3% of your rental income towards Capital Expenses, or CapEx. These are expenditures for larger, more significant repairs or replacements that may be required in the future, such as a new roof, kitchen or HVAC.

Proper budgeting for CapEx ensures that you have the necessary funds available when these expenses arise, which avoids the stress and financial burden of having to come up with the funds unexpectedly. By anticipating these expenses, you can effectively plan for the long-term success and maintenance of your rental property.

Subscription services of your Airbnb

Every successful Airbnb needs Wifi to keep your guests happy! You’ll need to include this cost in your estimates. Another one that comes to mind is Netflix (or a similar streaming service), which will be a great value add for guests. Most guests however use their own logins, so this if often times an unnecessary expense.

Let’s look at some example calculations for our Airbnb

We’re going to use some different assumptions and scenarios for each. I always include the FULL mortgage cost, even the capital portion, since I want to get a full picture of my cashflow in and out.

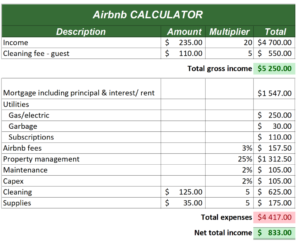

Example 1: Fully managed by a third party

Below you can see that even with a full time property manager, there’s still around $833 a month in net cashflow. Now let’s start tweaking that in different examples.

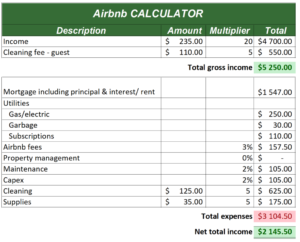

Example 2: Fully managed by yourself

With the self management option, we’re adding $1,312.50 to our bottom line. This brings us to $2,145.50 net monthly total. If you are able to self manage and want to earn that extra money, then this looks like a great option.

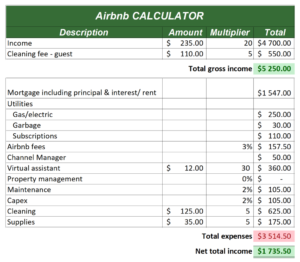

Example 3: Fully managed by yourself, some tech and an extra pair of hands

In this example, we’re adding a channel manager to help you automation your communication and workflow, as well as a virtual assistant for 30 hours a month.

Finally, you can also remove the cleaning fee in all of these calculations if you were going to perform that task yourself.

Understanding Federal Tax Obligations for Airbnb Hosts

As an Airbnb host, it’s important to be aware of your federal tax obligations. Your taxable income from Airbnb rentals will be calculated and reported on your federal income tax return. Additionally, some states may also require you to pay state income taxes on your rental income. It’s important to consult with a tax professional or accountant to determine your specific tax obligations and potential deductions that may impact your overall earnings. Remember, the total amount you earn from Airbnb rentals may not be the amount you take home after taxes are paid.

An overall summary for how to analyse your Airbnb property

Examine the calculations mentioned above and consider how changes in one area can affect your earnings. In this example, PMI insurance is not included, but if a downpayment of less than 20% had been made, you would have to add this to your mortgage payment.

Self-management and cleaning can result in additional savings if this is your first Airbnb property. Every situation is unique and individual preferences and experiences may vary. It’s important to consider all angles and determine what works best for you. There are however many way to maximize your Airbnb earnings over time.

Note that this example only covers one month, but it’s crucial to consider a full year as traffic patterns in various locations tend to fluctuate. It’s best to work on an average and tool like AirDNA will average out your earnings and occupancy rates to make this chore easy.

Wishing you the best of luck in your Airbnb venture!

Free airbnb analysis template download

If you want to download the template that I used in the example, please click the link below.

P.S. Want to know when my next article lands? Sign up below.